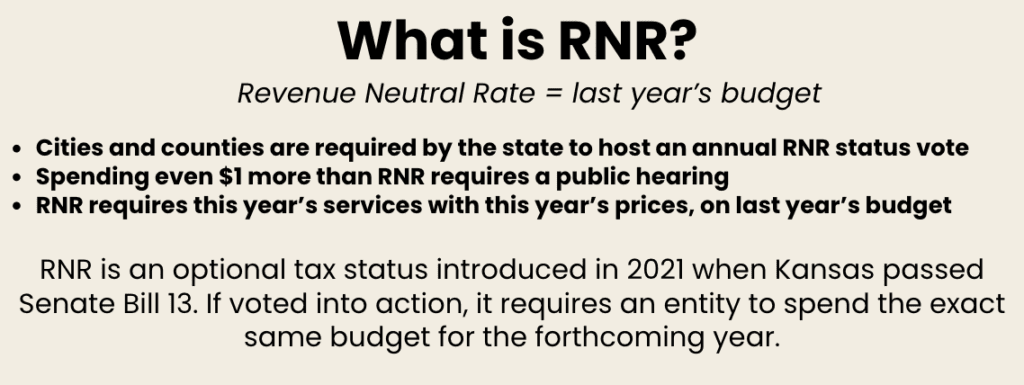

On Monday, September 8th, two county entities will hold RNR – revenue neutral rate – hearings. Clay County’s meeting is at 5:30 and USD 379’s hearing will be held prior to their school board meeting at 6 pm. These hearings are required by the state of Kansas, a change that took place in 2021.

Within an RNR hearing, taxing entities must publicly state their intent to collect more funds than the prior year. In contrast, adopting an RNR status means taking the exact same tax amount from the year prior. Exceeding that amount by even $1 requires an additional public hearing, even if the funds are not for an additional line item on the budget.

The state adopted this practice with the intent of creating transparency to taxpayers by explaining what the increases in the budget entails.