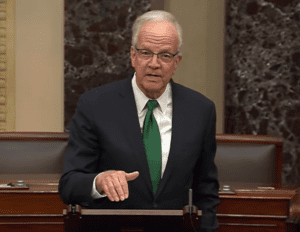

A bipartisan bill backed by U.S. Sen. Jerry Moran was reintroduced in the Senate this week to help ease the shortage of veterinary services in rural areas. A similar bill was introduced in the House. The Rural Veterinary Workforce Act would make student loan repayments tax-free for veterinarians who work in underserved communities, a benefit that already applies to doctors.

The Kansas Livestock Association says nearly every state is dealing with a rural vet shortage. The American Veterinary Medical Association, which supports the bill, notes that the USDA designated 243 rural vet shortage areas across 46 states this year, the highest ever.

Congress created the Veterinary Medicine Loan Repayment Program in 2003 to address the issue. It offers loan reimbursements to vets who commit to three years of service in underserved areas. But a heavy federal withholding tax reduces its impact.

The new bill would remove that tax burden, making loan repayment benefits from this and similar state programs tax-exempt. This would help more vets afford to work in rural areas and bring veterinary care in line with how similar programs support other healthcare workers.