Image courtesy Canva

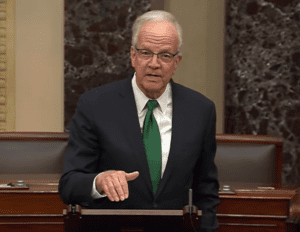

U.S. Senator Jerry Moran praised the Centers for Medicare and Medicaid Services’ (CMS) approval of Kansas’ 2025 provider tax preprint, which raises the provider tax for prospective payment system (PPS) hospitals from 3% to 6%. The increase will generate state revenue that is matched by federal Medicaid funds, boosting Medicaid rates for Kansas hospitals and physicians. The change is expected to provide roughly $1 billion annually for hospitals across the state.

In 2024, the Kansas Legislature passed legislation to increase the state provider tax for PPS hospitals. CMS approval was required to implement the change. Unlike Medicaid expansion states, which face a 3.5% provider tax cap under federal law, Kansas is not limited by this cap. The increase will allow Kansas hospitals to access higher federal reimbursements for the next decade.