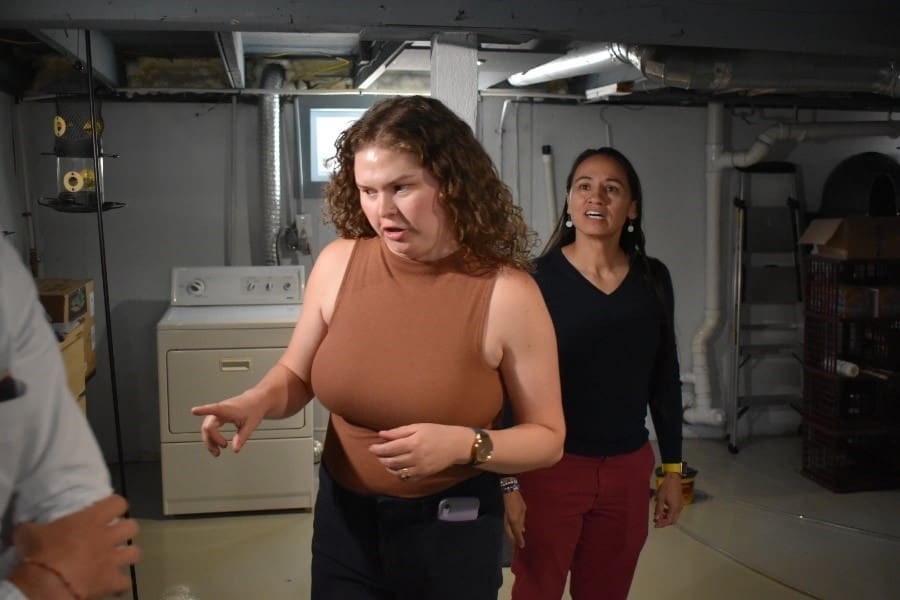

Representative Sharice Davids visited a family in Kansas City, KS on September 4 to see how new federal tax credits are helping Kansans reduce their utility costs. Kansans who make eligible energy-efficient upgrades to their homes may qualify for these tax credits, which have already saved over 3.4 million American families more than $8 billion. These savings stem from the Inflation Reduction Act, which Davids was the sole supporter of among Kansas’ congressional delegation.

Gayle Bergman and Anthony Null, the family Davids visited, spent $949 on a home energy audit and installed energy-efficient insulation in their basement. In return, they received a $285 tax credit when filing their taxes and are now enjoying lower monthly utility bills.

Eligible energy-efficiency improvements for tax credits include:

- Weatherization Projects: 30 percent tax credit, capped at:

- $1,200 per year for insulation and air sealing

- $250 per year per energy-efficient door (max $500)

- $600 per year for energy-efficient windows

- $150 per year for home energy audits

- Heat Pumps: 30 percent tax credit, capped at $2,000, for heat pump HVAC systems or water heaters

- Battery Storage: 30 percent tax credit with no cap

- Geothermal Heating: 30 percent tax credit with no cap

- Rooftop Solar: 30 percent tax credit with no cap, plus an additional 30 percent tax credit for a new electrical panel if installed with solar.

“These tax breaks, which I proudly supported in Congress, are making a real difference for Kansas families by reducing utility costs and encouraging energy-efficient home improvements,” said Davids. “Families like Gayle and Anthony’s are already seeing the benefits, with lower bills and more sustainable homes. I encourage everyone to explore these opportunities. They provide meaningful savings that can help ease the financial burden on hardworking Kansans and can cut pollution to protect our health at the same time.”