In 2024, Americans reported a total loss of $12.5 billion to fraud – an increase of 25% from the previous year. Of that, less than $3 billion was recovered – just 23.2%.

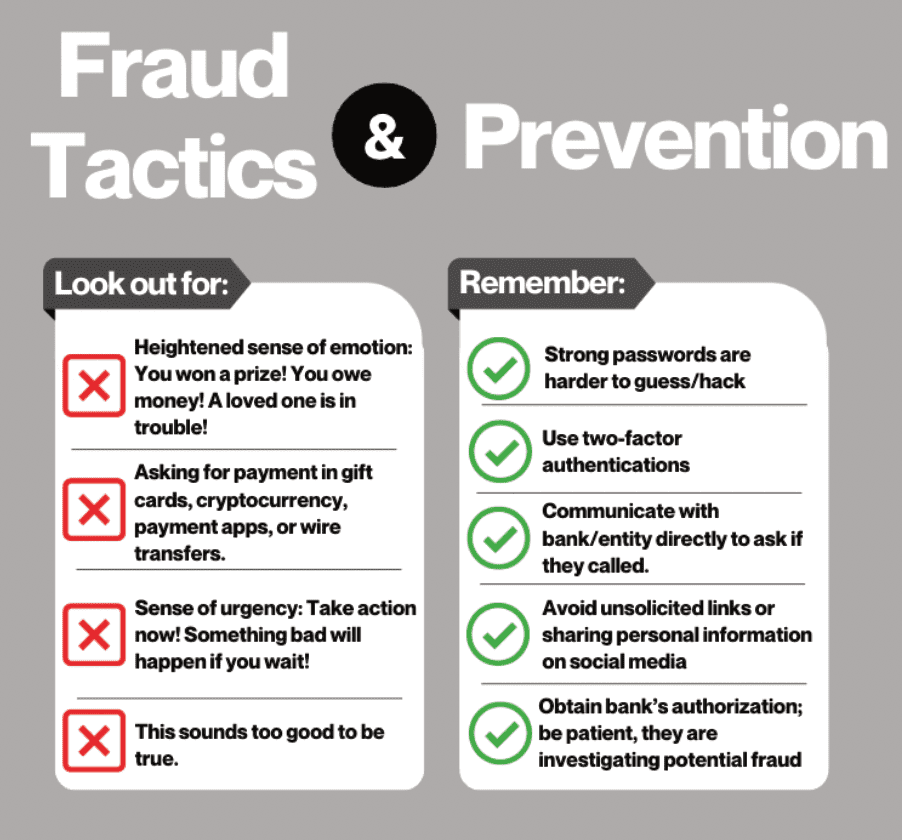

Sometimes the fraud is a link, a text or email claiming to be a bill that needs to be paid. Other times, it’s someone pretending to be your bank and requesting personal information. Others it’s a website that steals shopper information as they go to buy.

There’s catfishing, people pretending to be friends with a victim and asking for money as a favor. Romance scams pretend to be in a relationship with an individual. Or scammers pretend to be a relative who’s out of pocket and desperately in need of cash.

In most cases, there is manipulation – emotional or just feeding false details. Investment scams sit at the highest financial loss, $5.7 billion last year; these occur when folks believe they are contributing to their retirement or another business opportunity.

In reality, they are transferring large sums out of their own possession, never to be retrieved.

The loss rate remains high – and continues to increase annually – for a few reasons, said local bankers. One, being basic logistics.

“A lot of times we’re seeing money requests or transfers with platforms that use a debit card,” said VP of Operations, Alicia Lenhart at Union State Bank.

“Once it enters there, it’s gone. If you give authorization, you agreed; there’s no disputing that. Even if it was a scammer, you gave them permission. You have to be so careful about everything you put your card into.”

Then there are scams that involve the mail – scammers direct people to mail gift cards or cash. In these cases, scammers often ask the victim to provide pictures of the gift card, allowing them to redeem and immediately take the funds.

Sending cash in the mail is never a good idea, Lenhart said. Especially if the scammer asks for it to be hidden or withdrawn in small increments, small enough that it won’t raise suspicion.

“Fraudsters aren’t asking for $100,000, they’re going to do it in smaller amounts so they don’t get flagged,” said Brett Hubka, Community Bank President at GNBank in Clay Center. “There are businesses who do it regularly, but if it’s an individual who generally doesn’t withdraw a large amount, we’re going to ask questions.”

Lenhart agreed it’s common practice and done for the safety of customers.

“We try very hard, sometimes to an exhausting level, to protect our customers. We have to question them.” Head Customer Service Representative at USB, Tiffany Anderson added, “It is their money and you don’t want to have to ask those questions. But it’s better to do that than them going home heartbroken.”

In some cases, scammers will tell consumers to give a false story to the bank or family members – both local bank locations agree this is a huge red flag for fraud.

“We try to intercept that before it happens and be aware of customers who would not normally get out a significant amount of cash,” Lenhart said.

In addition, being asked to make a transaction in cryptocurrency should raise suspicions, or being asked to pay through an online app.

“Those are certain things that we see; just always be skeptical,” he said. “Look for misspellings or from something you didn’t do or didn’t buy, don’t click. I think anything is a scam anymore.”

Once a cryptocurrency transaction is involved, the money is essentially gone, said Jacob Lohrmeyer, Admin Team Member at Braden Financial Services.

“Crypto scams are very devastating; they’re essentially unrecoverable funds.”

Seniors remain a big target, likely due to their willingness to trust or not recognize a fraudulent request.

“We get a lot of calls from people saying Apple needs me to log in or they’re going to delete my account,” Anderson said. “Or it’s a program they are familiar with, whether or not they have it. These scammers are so good that they convince our customers.”

Lenhart added, “I have a real fear that we only hear about part of them because people are embarrassed,” she said. “It could happen to me. I’m absolutely convinced it could happen to me. They are just so good.” For instance, scammers who forge financial documents or even intercept emails with banking information – as technology advances, so do the tactics, she said.

To help combat investment scams, Braden Financial, holds bi-annual meetings for some clients to inform them of changes in scam tactics.

“Fraud is something we internally review because it’s so prevalent and we want to discuss it at all levels,” said Lohrmeyer. “It’s for all ages and education levels. Proactiveness and education is the best deterrents. Just continually inform yourself on the latest trends in that area.”

He added that one of the biggest issues they run into are privacy laws.

“Confidentiality is strict in the finance industry, so there are restrictions on communicating with outside parties – even close family members,” he said.

“We would encourage those who have experienced a scam to speak with their family and be open with them. Friends and family can offer support and be advocates for a victim of fraud. It can be challenging to bring that support around someone because of industry regulations that are present. Our hands are tied in some ways.”

In recent years the firm has introduced different security measures, like requiring additional identification for withdrawals.

Meanwhile, Hubka encouraged two-factor authentication when possible to help keep accounts as safe as possible. This involves consumers receiving a text or email in order to complete a transaction. This proves they are in control of that account or phone number, adding another layer of security.

More red flags include a sense of urgency; scammers want patrons to send funds before they have a chance to question the legitimacy.

“If they’re saying you have to do something now, that would be a red flag,” Hubka said. “It’s hard to stay in front of it but we do our best to protect our customers. If in doubt, come visit us first. It’s much better for you to come ask a bank about it.”

Anderson and Lenhart agreed with the sentiment.

“A good reason to bank at a community bank is that we’re trying to help and intercept that before it happens,” Lenhart said. “We care about our people.”